KPI Dashboard - Comparing and Benchmarking KPIs

Comparing & Benchmarking KPIs

Note: This post is the second post in Building KPIs dashboard Series.

IV. Wireframing A Dashboard

VI. Best practices for KPI analysis

Numbers Don’t Live in Void

42. That is the meaning of life. Any Hitchhiker's Guide to the Galaxy fans? Not all numbers are this exciting as this one when used in the void without any context.

What if I told you on the phone that one of my friend’s daughter earned 23 points in a game. What would you think, is it a good score? Is it a bad score?

Another example - I tell you that “some stock” is trading today at $30, and I do not reveal any further information and ask you to buy the stock. Would you buy it? No? Why not? Because you just don’t know what the heck that $30 even means. You will start asking questions like

What was stock’s price yesterday

What was stock’s price a year ago, three years ago

What does that price look as compared with its earnings

How does the price compare to your broker’s buy recommendations

How does the price compare to the dividend distributed by the company in the past

And when you have the answer to the above questions, probably the number of $30 will make more sense to you. So you see, numbers do not live in the void. They always need a context. Sometimes we already have some context based on our previous experiences and knowledge (if I told you after a week that “some stock” today is trading at $24, you will know it has fallen down by 20% because you already knew its earlier price was $30)

In order to understand a KPI in a better context, we need it to be compared with a target value, some normal expected value, and the value it has shown in the past.

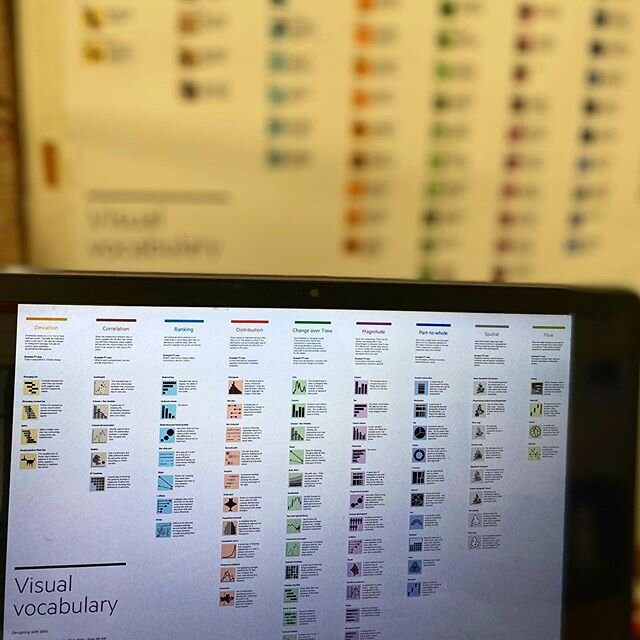

Ways to Compare a KPI

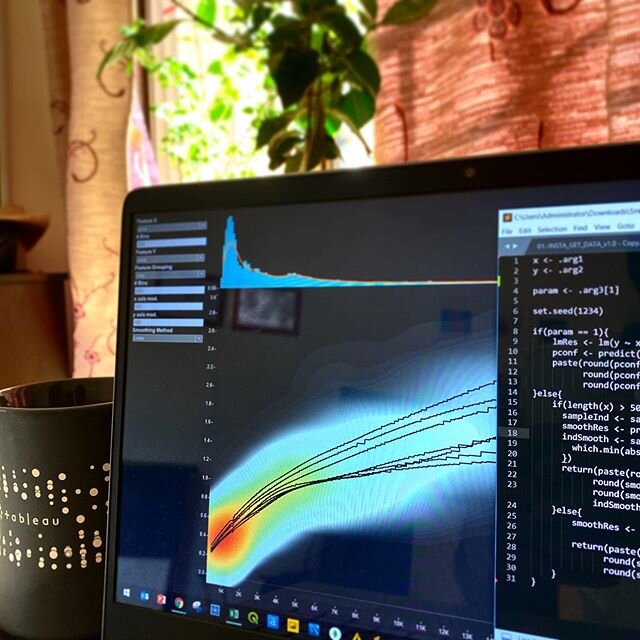

Numbers can be seen and compared in many ways - sometimes by showing trend along with time, sometimes by dividing it with other numbers and look at it as a ratio or percentage.

Here are some more common ways to compare numbers in the business dashboards:

As a percentage of target

Trend analysis over time

See as growth from previous periods

Segment by geography and compare

Segment by product and compare

Segment by customer and compare

Compare against internal best-in-class and understand the reason behind the gap

Compare against the industry average and see where you stand

Compare against industry best in class and analyze gap in best-practices

Comparing KPI with Target (Variance Analysis)

Favorite of every board-room🎯 wins you awards 🏆

The most common way to compare a KPI is to divide it by its target and show it as a percentage. It is also important to the absolute variance if the KPI is additive in nature.

Also, taking the comparison further, the top contributors to the positive and negative variance can be shown too. It will give a holistic picture of the KPI against the target, and some insight into where might be the problem. Though this kind of comparison is not sufficient for root-cause-analysis, it probably is the best place for the starting point.

Dividing KPI by another KPI (Normalization)

The art of turning oranges 🍊 into apples 🍎

Absolute values are easy to understand, but never sufficient to make an “apple-to-apple” comparison. As I write this post, the world is fighting against Corona Virus. Every single dashboard out there presents the number of active cases. As I write this sentence, Russia has 308K cases, and Italy has 226K. However, how much does it make sense to compare these two countries based on these statistics? One might say the condition in Russia is worst than Italy because Russia has 36% more cases than Italy.

But think about this: Russia has a population of 144 Million and Italy 60 Million. In our words, in Russia every 1 out of 460 people in infected with Corona while in Italy every 1 out of 265 people has a corona. Or we can say if you randomly meet a person from either of these countries, It is almost twice as likely that an Italian is infected with Corona than a Russian is.

Note: This was a randomly taken example from the top 10 countries as on the date (20 May 2020).

Now come to the business world. A less selling product which is generating a profit of $10 Million and a high selling product generating a profit of $25 Million. Now management decides to make a plan to increase profit in the next business year. Which product you would like to spend more marketing dollars and increase profit from? Second product? Because it has 1.5x more profit than the first product? Wrong! You will also need to check the profitability (that is profit/revenue), growth potential, and extra marketing dollars to generate additional sales for the product.

What if Product A has a profitability of 30% as compared to 15% for Product B? Which one looks more interesting to make more profits? Think about it. And if you are making a dashboard which will be used by the Business Strategy team, would you not like to add profit margin along-with absolute profit for apple-to-apple comparison between Product A and Product B?

Tip: If you want to get into the heart of what I am talking about here, read Factfulness by Prof. Hans Rosling. He makes an argument to measure CO2 emissions per capita instead of measuring CO2 million-tons while comparing different countries. I wish he were alive, especially during a difficult time like this when the world much needed a public health expert like him.

Comparing KPI against Time (Trend Analysis)

Continuous improvement? Sustainability? Take a pulse 📈📉

This is more complicated than comparing against the target. Because one can have more than one choices to compare against time:

Should I see a daily trend? How to treat the dip in sales on every Sunday?

Should I see a weekly trend? How to treat the slow sales at the start of the month and high volumes towards the end?

Should I see a monthly trend? How to interpret the sales dip during the off-season from Jan to Mar?

Should I see an annual sales trend? How far going back into history would be relevant?

It is the middle of the month right now. Should I compare with a daily average of full last month or only till mid of the month?

There is no end to this. And there is no single correct answer. Every situation demands a different kind of comparisons. However, as long as you follow some basic rules, you can fir the trend analysis to your needs. For most large companies, the following kind of time bases comparisons often make sense

A daily trend

Mostly in operational dashboards. Complemented by an average daily sales by day, an average per day target reference line, and a cumulative sales trend compared with last month’s cumulative sales trend, MTD target achievement percent

A Monthly Trend

In both executive and operational dashboards. Complemented by monthly targets references, month on month growth from last year, last year same month actual values references.

A Quarterly Trend

Mostly in executive review dashboards - mainly in finance-related. Always compared with the target, the previous quarter, and the same quarter last year.

Annual Trend

The favorite kind of chart of finance and manufacturing industry. In manufacturing sometimes even the trend of 5 years is shown because it is hard to change things in a large plant with a short span of time and sometimes changes and their effects take 2 to 3 years to complete and show the effect. Such long horizons do not need to show comparison against target because no-one really remembers or cares for what were our targets 5 years ago. Only year over the change in the actual value matters here.

Comparing Products

A product is something made in a factory; a brand is something that is bought by the customer. A product can be copied by a competitor; a brand is unique. A product can be quickly outdated; a successful brand is timeless. 💎

- Stephen King

Whenever a new product is launched, in most of cases, if everything goes as per plan, its sales trajectory looks like this:

You are a brand manager in a consumer goods giant, and just launched a new product two weeks ago and want to monitor how the new product performs. Maybe you’d like to measure penetration in target stores, maybe after two weeks, you want to measure the repeat purchase, maybe you want to see if the new launch product is not eating revenue from another exiting product instead of generating additional revenue. How do you do that? What kind of comparison would you like to see on the dashboard?

There is a reasonably good chance that your target projections are not going to be very accurate. At least for the first few months. So even though you will add a KPI for that, it will not a very good picture. Also, this is the first time you launched this product so you cannot compare it with last year's data because it simply doesn’t exist yet. Companies launch new products all the time. And more often than not, the initial trajectory follows the same pattern, even though the size of the market may vary. Trust me or not, it is a better idea to get the data of another product which you launched two years back, and plot against your newly launched product. If you are lucky enough, maybe the manager who launched the old product is still in your team or maybe if that launch went well, is your current boss ;)

Take early cues from what the data tells you with that kind of comparison. I am sure, this one extra curve plotted on your chart will add a lot value in your NPD product launch dashboards.

Comparing Geographies (Best-in-class ranking)

Comparing geographies is no less different than the concept of normalization we discussed above. While comparing absolute KPIs like sales between two different geographies, it makes a lot more sense to compare sales growth instead of sales revenue because sales geographies differ in size and number of people who live within those geographies.

Another common problem with large organizations is that their sales geographies keep changing all the time. That means if one city falls under North A region today, it might get restructured under North B tomorrow. And when that happens, all kinds of comparisons might go haywire, if the data is not correctly accounted for that. Which means, all the historical sales of North A should be reported under North B when for the years when the city was in the North A. Reason? It is obvious - to compare apples with apples. If you don’t do so, North B will show unduly positive growth while North A will under-report its growth just because customers of a city which used to be its part in the last year, are no longer “part of its customer master data”.

Comparing Your Business with Industry (Benchmarking)

Optimize with internal comparisons, strive for excellence with external comparisons📏

No matter how different two leading organizations might be within the same industry, they always share a few traits. Those traits could be better the use of technology, a competitive advantage, or anything else. Unfortunately, these efficiencies are closely guarded secrets. However, also, publicly-traded large companies are required to share a fair amount of data with the public.

With some smart work, and combined with a sold market intelligence, you can take your top competitors’ data and build a solid competition intelligence system that can be used by your management, and marketing team to come up with innovations and strategy which will help you in the long run.

If your competitor’s revenue has grown by 10% while the profit increased by 15%, where that additional 5% efficiency came from? Is it because of fixed cost utilization by your competitor or something else which might be hidden under financial ratios? Such bench-marking will always help you you to ask these kinds of questions and look for an answer.

I hope you enjoyed reading the second article in the series. Read part III of the series Drill-down into KPIs. Any questions? Hit below in comments. Cheers.

If you are a project manager and want to hire me to build a KPI Dashboard for your department, contact me to schedule a discussion.

Follow me on Instagram to hear about next updates on this series in the coming week.